An exchange market pressure measure for cross country analysis

Patnaik, Ila, Joshua Felman, and Ajay Shah. "An exchange market pressure measure for cross

country analysis." Journal of International Money and Finance,

73 (2017): 62-77

Desai, Mohit, Ila Patnaik, Joshua Felman, and Ajay Shah. "A cross-country Exchange Market Pressure (EMP) Dataset." Data in Brief (2017)

|

EMP measures in the existing literature are oriented towards applications in crisis dating and prediction. We propose a modified EMP measure where cross-country comparisons are possible. This is the sum of the observed change in the exchange rate with an estimated counterfactual of the magnitude of the change in the exchange rate associated with the observed currency intervention. We construct a multi-country dataset for EMP in each month. This opens up many new research possibilities. |

Links

- Article in Journal of International Money and Finance

- Article in Data in Brief

Press

- Improved measurement of Exchange Market Pressure (EMP) by Ila Patnaik, Joshua Felman, Ajay Shah, on Ajay Shah's blog, 27thMay 2017.

Data

- EMP dataset_v_1.1, version 1, countries = 139, period = January 1996 to May 2017. Release notes: Improved measurement of Exchange Market Pressure (EMP), by Joshua Felman, Ila Patnaik, Ajay Shah, The Leap Blog, 27 May 2017.

- EMP dataset_v_2.0, version 2, countries = 135, period = January 1996 to November 2018. Release notes: Release of v2.0 of the Exchange Market Pressure dataset associated with PFM 2017, by Joshua Felman, Madhur Mehta, Ila Patnaik, Ajay Shah, Bhavyaa Sharma, The Leap Blog, 6 April 2020.

- EMP_allcountries_v_2.1, version 2.1, countries = 75, period = January 1996 to December 2019. Release notes: Exchange Market Pressure: Data release Version 2.1, by Madhur Mehta, The Leap Blog, 23 June 2021.

Code

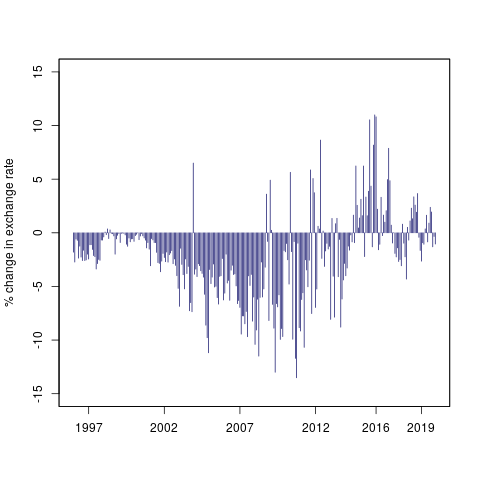

To get working with the dataset, here's a short demo R code for loading the dataset and plotting the EMP values for any of the 75 countries in our dataset:

## 1) Read the EMP dataset library(zoo) emp.dat <- read.csv("https://macrofinance.nipfp.org.in/FILES/EMP_allcountries_v_2.1.csv") ## 2) Split the dataset by country name emp.dat.list <- split(emp.dat,emp.dat$country) ## 3) Country names are stored as ISO alpha 2 code of the country followed by ".curr". For example - China is stored as "cn.curr". Now we get the 2 letter country code for China library(ISOcodes) ## Load the dataset of country code data(ISO_3166_1) china_cocode <- paste(tolower(ISO_3166_1[grep("^China$",ISO_3166_1$Name),"Alpha_2"]),".curr",sep="") ## 4) Data for EMP values of China china.emp <- emp.dat.list[[china_cocode]] china.emp <- zoo(china.emp[,-1],as.Date(china.emp[,1])) ## 5) Plot China EMP plot(china.emp$curr.emp,ylab="% change in exchange rate",xlab="",type="h",col="midnight blue",ylim=c(-15,15),xaxt = "n") axis(1, labels = c("1997","2002","2007","2012","2016","2019"), at = c(as.Date("1997-01-01"),as.Date("2002-01-01"),as.Date("2007-01-01" ),as.Date("2012-01-01"),as.Date("2016-01-01"),as.Date("2019-01-01") ))

The above code yields the following graph for China:

|

| Figure 1: Exchange Market Pressure (EMP) values for China |

Appendix

The following table lists all the countries and their availability in different EMP data set versions.

| S.No. | Country | Version 1.1 | Version 2.0 | Version 2.1 |

|---|---|---|---|---|

| 1 | Algeria | Yes | Yes | No |

| 2 | Angola | Yes | Yes | No |

| 3 | Antigua & Barbuda | Yes | Yes | No |

| 4 | Argentina | Yes | Yes | Yes |

| 5 | Armenia | Yes | Yes | Yes |

| 6 | Aruba | Yes | Yes | No |

| 7 | Australia | Yes | Yes | Yes |

| 8 | Austria | Yes | Yes | Yes |

| 9 | Azerbaijan | Yes | Yes | No |

| 10 | Bahamas | Yes | Yes | No |

| 11 | Bahrain | Yes | Yes | No |

| 12 | Bangladesh | Yes | Yes | No |

| 13 | Barbados | Yes | Yes | No |

| 14 | Belarus | Yes | Yes | Yes |

| 15 | Belgium | Yes | Yes | Yes |

| 16 | Belize | Yes | Yes | No |

| 17 | Bhutan | Yes | Yes | No |

| 18 | Bolivia | Yes | Yes | Yes |

| 19 | Bosnia & Herzegovina | Yes | Yes | No |

| 20 | Botswana | Yes | Yes | No |

| 21 | Brazil | Yes | Yes | Yes |

| 22 | Brunei | Yes | Yes | No |

| 23 | Bulgaria | Yes | Yes | Yes |

| 24 | Cambodia | Yes | Yes | No |

| 25 | Canada | Yes | Yes | Yes |

| 26 | Central African Republic | Yes | Yes | No |

| 27 | Chile | Yes | Yes | Yes |

| 28 | China | Yes | Yes | Yes |

| 29 | Colombia | Yes | Yes | Yes |

| 30 | Comoros | Yes | Yes | No |

| 31 | Congo - Kinshasa | Yes | Yes | No |

| 32 | Costa Rica | Yes | Yes | Yes |

| 33 | Cote d'Ivoire | Yes | Yes | No |

| 34 | Croatia | Yes | Yes | Yes |

| 35 | Cyprus | Yes | Yes | Yes |

| 36 | Czechia | Yes | Yes | Yes |

| 37 | Denmark | Yes | Yes | Yes |

| 38 | Djibouti | Yes | Yes | No |

| 39 | Dominican Republic | Yes | Yes | Yes |

| 40 | Egypt | Yes | Yes | Yes |

| 41 | El Salvador | Yes | Yes | Yes |

| 42 | Eritrea | Yes | Yes | No |

| 43 | Estonia | Yes | Yes | Yes |

| 44 | Eswatini | Yes | Yes | No |

| 45 | Fiji | Yes | Yes | No |

| 46 | Finland | Yes | Yes | Yes |

| 47 | France | Yes | Yes | Yes |

| 48 | Gambia | Yes | Yes | No |

| 49 | Georgia | Yes | Yes | Yes |

| 50 | Germany | Yes | Yes | Yes |

| 51 | Greece | Yes | Yes | Yes |

| 52 | Guatemala | Yes | Yes | Yes |

| 53 | Guinea | Yes | Yes | No |

| 54 | Guyana | Yes | Yes | No |

| 55 | Haiti | Yes | Yes | No |

| 56 | Honduras | Yes | Yes | Yes |

| 57 | Hong Kong | Yes | Yes | Yes |

| 58 | Hungary | Yes | Yes | Yes |

| 59 | Iceland | Yes | Yes | Yes |

| 60 | India | Yes | Yes | Yes |

| 61 | Indonesia | Yes | Yes | Yes |

| 62 | Iraq | Yes | Yes | No |

| 63 | Ireland | Yes | Yes | Yes |

| 64 | Israel | Yes | Yes | Yes |

| 65 | Italy | Yes | Yes | Yes |

| 66 | Jamaica | Yes | Yes | Yes |

| 67 | Japan | Yes | Yes | Yes |

| 68 | Jordan | Yes | Yes | Yes |

| 69 | Kazakhstan | Yes | Yes | Yes |

| 70 | Kenya | Yes | Yes | No |

| 71 | Kuwait | Yes | Yes | No |

| 72 | Kyrgyzstan | Yes | Yes | Yes |

| 73 | Laos | Yes | Yes | No |

| 74 | Lebanon | Yes | Yes | No |

| 75 | Liberia | Yes | Yes | No |

| 76 | Libya | Yes | Yes | No |

| 77 | Lithuania | Yes | Yes | Yes |

| 78 | Luxembourg | Yes | Yes | Yes |

| 79 | Macao | Yes | Yes | No |

| 80 | Madagascar | Yes | Yes | No |

| 81 | Malawi | Yes | Yes | No |

| 82 | Malaysia | Yes | Yes | Yes |

| 83 | Maldives | Yes | Yes | No |

| 84 | Malta | Yes | Yes | Yes |

| 85 | Mauritania | Yes | Yes | No |

| 86 | Mauritius | Yes | Yes | Yes |

| 87 | Mexico | Yes | Yes | Yes |

| 88 | Moldova | Yes | Yes | No |

| 89 | Mongolia | Yes | Yes | Yes |

| 90 | Morocco | Yes | Yes | Yes |

| 91 | Mozambique | Yes | Yes | No |

| 92 | Myanmar (Burma) | Yes | No | No |

| 93 | Nepal | Yes | Yes | No |

| 94 | Netherlands | Yes | Yes | Yes |

| 95 | New Zealand | Yes | Yes | Yes |

| 96 | North Macedonia | Yes | Yes | Yes |

| 97 | Norway | Yes | Yes | Yes |

| 98 | Oman | Yes | Yes | No |

| 99 | Pakistan | Yes | Yes | No |

| 100 | Peru | Yes | Yes | Yes |

| 101 | Philippines | Yes | Yes | Yes |

| 102 | Poland | Yes | Yes | Yes |

| 103 | Portugal | Yes | Yes | Yes |

| 104 | Qatar | Yes | Yes | No |

| 105 | Romania | Yes | Yes | Yes |

| 106 | Russia | Yes | Yes | Yes |

| 107 | Rwanda | Yes | Yes | No |

| 108 | Samoa | Yes | Yes | No |

| 109 | Saudi Arabia | Yes | Yes | Yes |

| 110 | Serbia | Yes | Yes | No |

| 111 | Seychelles | Yes | Yes | Yes |

| 112 | Sierra Leone | Yes | Yes | No |

| 113 | Singapore | Yes | Yes | Yes |

| 114 | Slovakia | Yes | Yes | Yes |

| 115 | Slovenia | Yes | Yes | Yes |

| 116 | Solomon Islands | Yes | Yes | No |

| 117 | South Africa | Yes | Yes | Yes |

| 118 | South Korea | Yes | Yes | Yes |

| 119 | Sri Lanka | Yes | Yes | Yes |

| 120 | Suriname | Yes | No | No |

| 121 | Sweden | Yes | Yes | Yes |

| 122 | Switzerland | Yes | Yes | Yes |

| 123 | Syria | Yes | Yes | No |

| 124 | Tajikistan | Yes | Yes | No |

| 125 | Tanzania | Yes | Yes | No |

| 126 | Thailand | Yes | Yes | Yes |

| 127 | Tonga | Yes | Yes | No |

| 128 | Trinidad & Tobago | Yes | No | No |

| 129 | Turkey | Yes | Yes | Yes |

| 130 | Uganda | Yes | Yes | No |

| 131 | Ukraine | Yes | Yes | Yes |

| 132 | United Arab Emirates | Yes | Yes | No |

| 133 | United Kingdom | Yes | Yes | Yes |

| 134 | Uruguay | Yes | Yes | Yes |

| 135 | Vanuatu | Yes | Yes | No |

| 136 | Venezuela | Yes | Yes | No |

| 137 | Vietnam | Yes | Yes | No |

| 138 | Yemen | Yes | No | No |

| 139 | Zambia | Yes | Yes | No |